Saving money is a goal that many of us have, but it can be challenging to stay on track. That’s where the popular 52 Week Money Challenge comes in. This money-saving technique has gained traction in recent years and is a fun and effective way to save up for a specific financial goal. Let’s take a closer look at how it works and why it has become so popular.

What is the 52 Week Money Challenge?

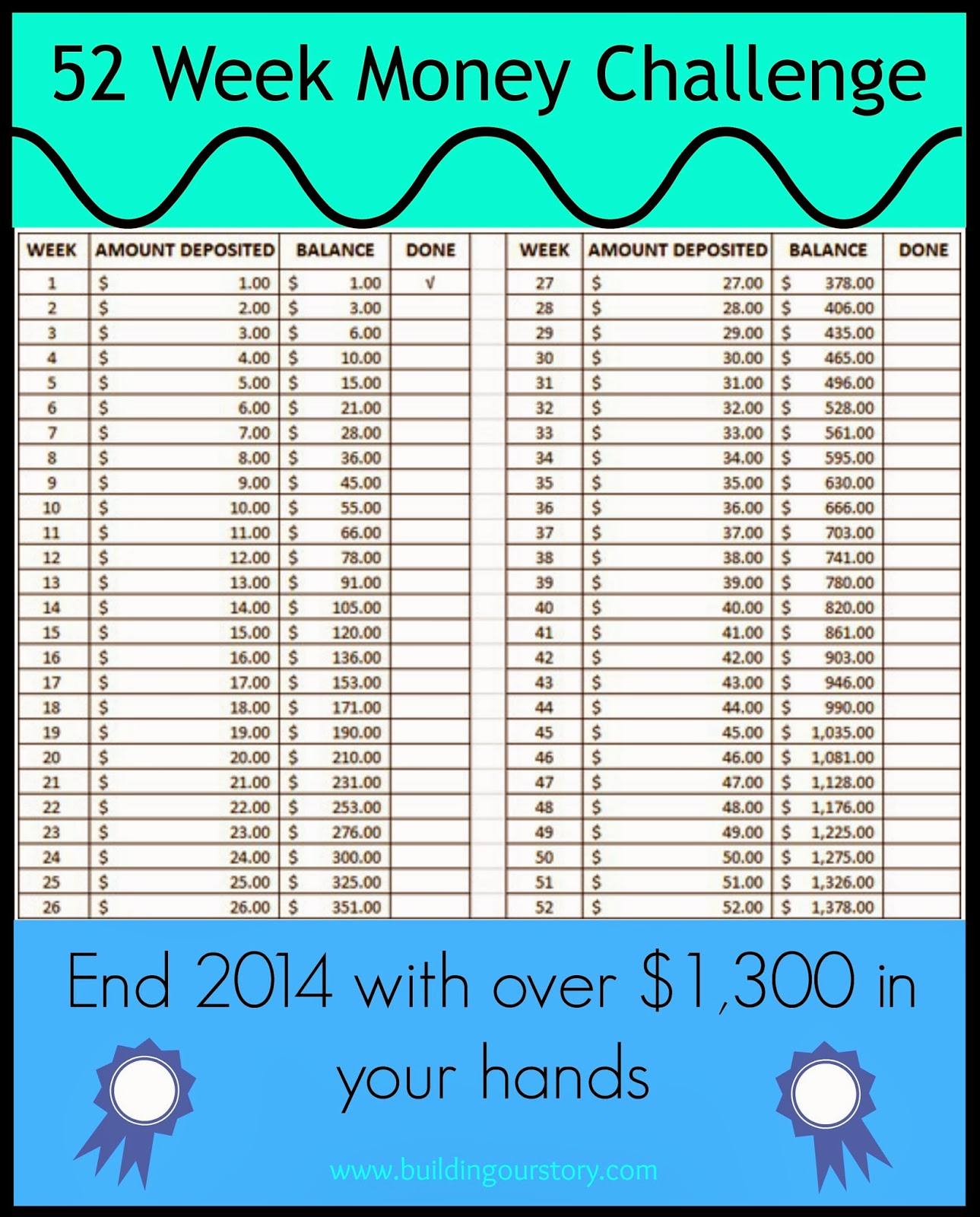

The 52 Week Money Challenge is a savings strategy that encourages you to gradually increase your savings throughout the year. It follows a simple and easy-to-follow format. The basic idea is to save a specific amount of money each week for 52 weeks. You start by saving $1 in the first week, and then increase the amount by $1 each week. By the end of the challenge, you will have saved $1,378.

The 52 Week Money Challenge is a savings strategy that encourages you to gradually increase your savings throughout the year. It follows a simple and easy-to-follow format. The basic idea is to save a specific amount of money each week for 52 weeks. You start by saving $1 in the first week, and then increase the amount by $1 each week. By the end of the challenge, you will have saved $1,378.

Why is it Popular?

One of the reasons why the 52 Week Money Challenge has become so popular is its simplicity. The increasing pattern of savings makes it easier to adjust to the challenge over time. Saving $1 in the first week is manageable for almost anyone, and as the weeks progress, the increase in the amount saved is gradual and less overwhelming. It allows individuals to build a habit of saving without feeling burdened.

One of the reasons why the 52 Week Money Challenge has become so popular is its simplicity. The increasing pattern of savings makes it easier to adjust to the challenge over time. Saving $1 in the first week is manageable for almost anyone, and as the weeks progress, the increase in the amount saved is gradual and less overwhelming. It allows individuals to build a habit of saving without feeling burdened.

Another reason for its popularity is the visual aspect of the challenge. Many people find it motivating to see their savings grow week by week, especially when they have a physical representation of their progress. The challenge often includes a chart or printable where you can cross off each week as you save the corresponding amount. This visual reminder helps to track your progress and stay motivated to continue saving.

How to Get Started

If you’re interested in taking on the 52 Week Money Challenge, getting started is easy. First, find a printable or create your own chart to track your progress. Many websites offer free printables that you can use. Once you have your chart, hang it somewhere visible, like your refrigerator or a bulletin board.

If you’re interested in taking on the 52 Week Money Challenge, getting started is easy. First, find a printable or create your own chart to track your progress. Many websites offer free printables that you can use. Once you have your chart, hang it somewhere visible, like your refrigerator or a bulletin board.

Next, decide on your financial goal. The challenge is often used to save up for a specific purpose, such as a vacation, emergency fund, or down payment on a house. Having a goal in mind will help you stay motivated throughout the year.

Each week, deposit the designated amount into a savings account or a jar if you prefer cash. Make it a habit to save the money at the same time each week, such as on payday. As the weeks progress, you’ll experience the satisfaction of watching your savings grow.

Conclusion

The 52 Week Money Challenge is a popular and effective method to save money in a gradual and manageable way. It’s a great tool for building a savings habit and achieving your financial goals. Whether you want to save up for a dream vacation, build an emergency fund, or pay off debt, the challenge can help you get there. So why not give it a try and see how much you can save in a year?

The 52 Week Money Challenge is a popular and effective method to save money in a gradual and manageable way. It’s a great tool for building a savings habit and achieving your financial goals. Whether you want to save up for a dream vacation, build an emergency fund, or pay off debt, the challenge can help you get there. So why not give it a try and see how much you can save in a year?

Remember, consistency is key when it comes to saving money. Stick to the plan and resist the temptation to skip a week or decrease the amount saved. With determination and discipline, you’ll be able to reach your savings goal and enjoy the financial security that comes with it. Good luck!