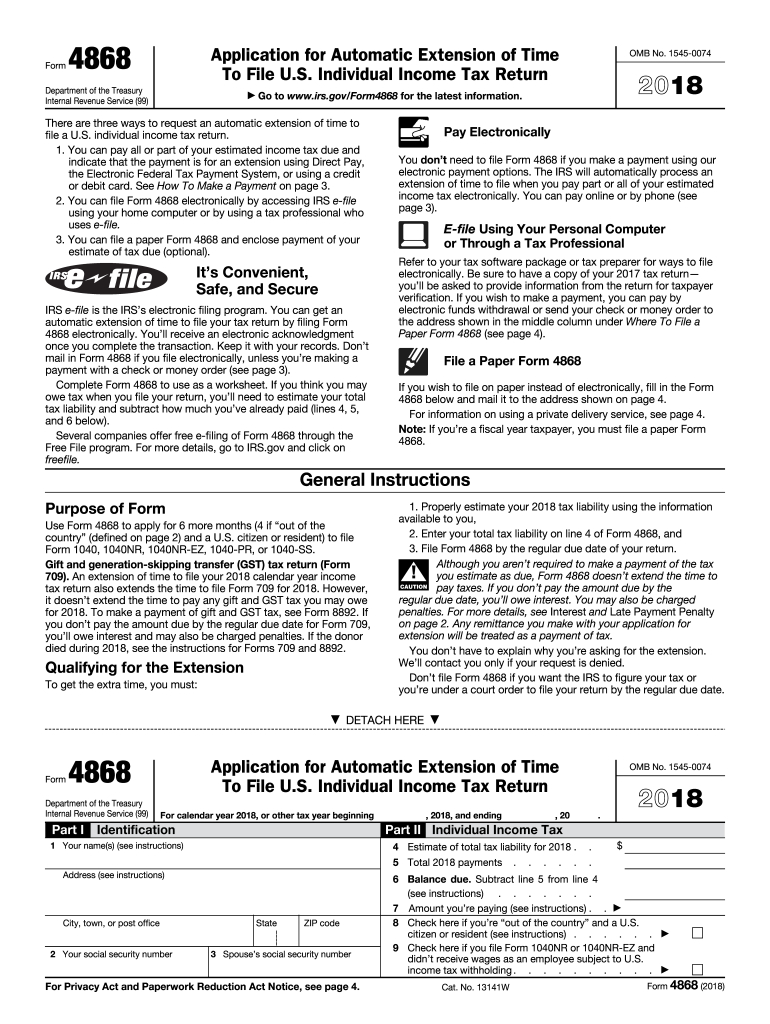

Are you in need of an IRS extension form to file your taxes? Look no further, because we have just what you need! Our printable IRS Form 4868 is the perfect solution to help you extend your filing deadline. With this form, you can easily request additional time to prepare and file your tax return, giving you some breathing room during this tax season.

Print IRS Extension Form 4868 - Your Tax Filing Lifesaver

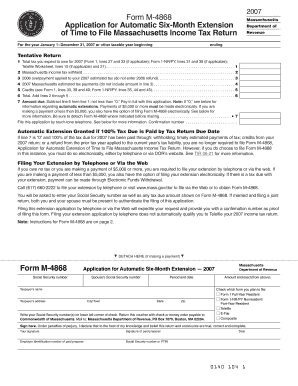

Our printable IRS Extension Form 4868 is specifically designed to make your life easier during tax season. With this form, you can request an automatic extension of time to file your individual income tax return. Whether you need a little extra time to gather your financial documents or simply need more time to complete your return accurately, this form has got you covered.

Using our printable IRS Extension Form 4868 is incredibly convenient. Simply download the form, print it out, and follow the instructions to fill it out accurately. The form includes all the necessary fields for you to provide your personal information, estimated tax liability, and the amount you are paying with the extension.

Using our printable IRS Extension Form 4868 is incredibly convenient. Simply download the form, print it out, and follow the instructions to fill it out accurately. The form includes all the necessary fields for you to provide your personal information, estimated tax liability, and the amount you are paying with the extension.

Why Choose Our Printable IRS Extension Form 4868?

When it comes to filing your taxes, having the right resources is crucial. Here are a few reasons why our printable IRS Extension Form 4868 is the ideal choice:

- Convenience: Our printable form allows you to complete the extension request at your own pace, without the pressure of a looming deadline.

- Accuracy: The form is designed to ensure you provide all the necessary information required by the IRS, reducing the chances of errors or omissions.

- Flexibility: With the extension, you have the freedom to file your tax return by the extended deadline, giving you ample time to double-check your figures and ensure accuracy.

Don’t let the stress of tax season get to you. Take advantage of our printable IRS Extension Form 4868 and give yourself the time you need to file your tax return accurately. Remember, an extension does not grant you extra time to pay your taxes, so make sure to estimate your tax liability and make any necessary payments along with your extension request.

Don’t let the stress of tax season get to you. Take advantage of our printable IRS Extension Form 4868 and give yourself the time you need to file your tax return accurately. Remember, an extension does not grant you extra time to pay your taxes, so make sure to estimate your tax liability and make any necessary payments along with your extension request.

How to Use Our Printable IRS Extension Form 4868

Using our printable IRS Extension Form 4868 is a straightforward process. Here’s a step-by-step guide:

- Download the form from our website.

- Print it out on standard letter-sized paper.

- Read the instructions carefully, as they provide essential guidance for filling out the form accurately.

- Fill out all the required fields, including your personal information, estimated tax liability, and the payment amount.

- Double-check your entries to ensure accuracy.

- Sign and date the form.

- Keep a copy of the completed form for your records.

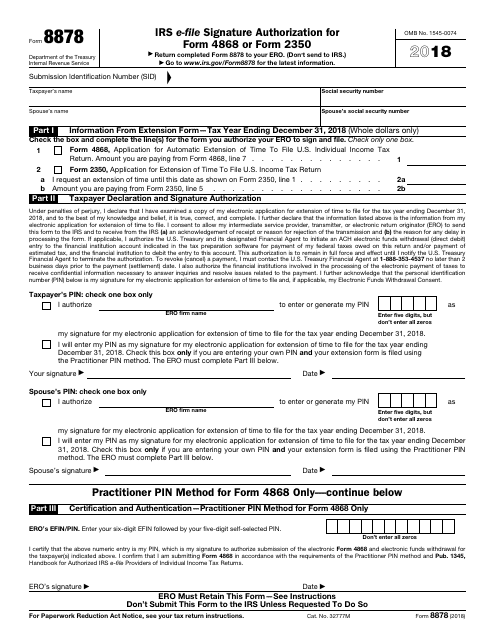

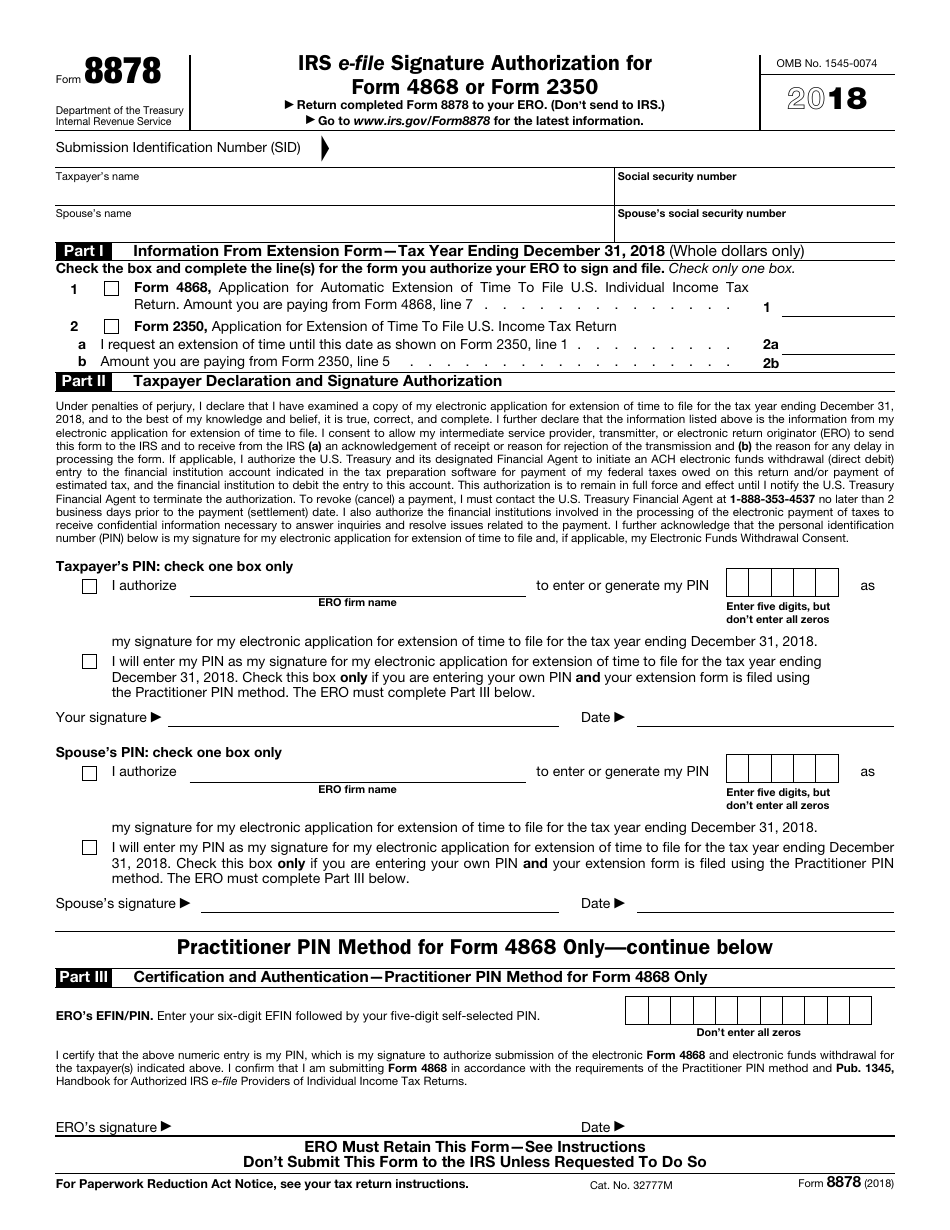

Once you’ve completed the form, you can submit it to the IRS via mail or electronically. Remember to send your extension request to the appropriate address, as indicated in the instructions. In case you choose to file electronically, you can use our printable IRS Form 8878, which allows for secure e-filing with an electronic signature.

Once you’ve completed the form, you can submit it to the IRS via mail or electronically. Remember to send your extension request to the appropriate address, as indicated in the instructions. In case you choose to file electronically, you can use our printable IRS Form 8878, which allows for secure e-filing with an electronic signature.

Get the Extra Time You Need with Our IRS Extension Form 4868

Don’t stress over meeting the tax filing deadline. Use our printable IRS Extension Form 4868 to request the additional time you need to ensure a thorough and accurate tax return. Our form is easy to use, convenient, and designed to simplify the extension request process.

Take control of your tax filing process today. Download our printable IRS Extension Form 4868 and file for your extension with ease. Remember, an extension gives you more time to file, but you must estimate and pay your taxes by the original deadline to avoid penalties and interest. Get started now and enjoy the peace of mind of having extra time to complete your tax return!

Take control of your tax filing process today. Download our printable IRS Extension Form 4868 and file for your extension with ease. Remember, an extension gives you more time to file, but you must estimate and pay your taxes by the original deadline to avoid penalties and interest. Get started now and enjoy the peace of mind of having extra time to complete your tax return!