When it comes to managing your taxes and filing the necessary forms, it’s crucial to stay informed and make the process as smooth as possible. One form that many individuals and businesses need to familiarize themselves with is the 1099 form. This form is primarily used to report income earned from various sources other than regular employment wages. In this post, we will explore some important aspects of the 1099 form and provide helpful resources to guide you through the process.

E-File 1099 | File Form 1099 Online | Form 1099 for 2020

If you prefer to file your 1099 forms online, this resource provides an easy and convenient solution. The website allows you to quickly and securely e-file your 1099 forms for the year 2020. By utilizing this service, you can save time and ensure that your forms are submitted accurately and in a timely manner.

If you prefer to file your 1099 forms online, this resource provides an easy and convenient solution. The website allows you to quickly and securely e-file your 1099 forms for the year 2020. By utilizing this service, you can save time and ensure that your forms are submitted accurately and in a timely manner.

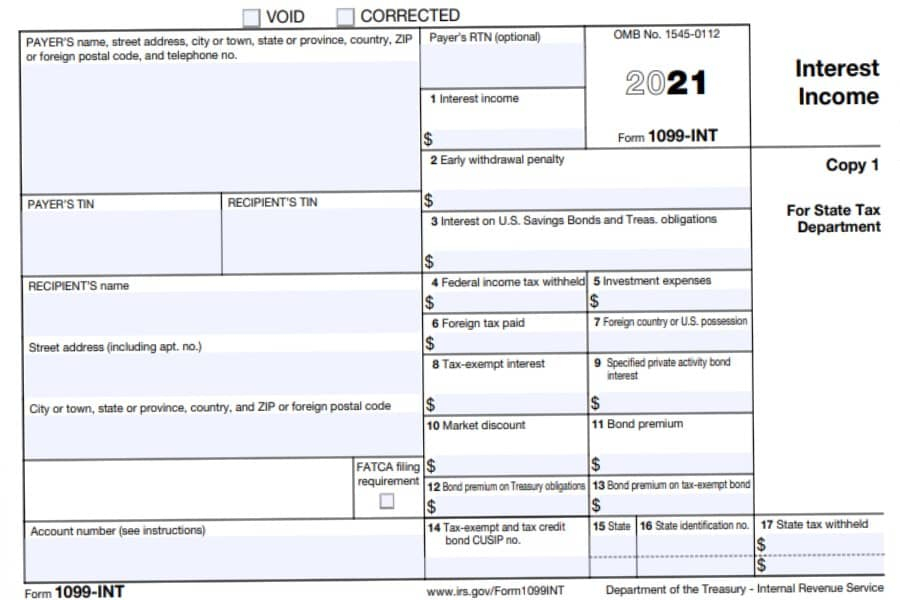

Printable 1099 Div Form 2021 | Printable Form 2021

If you prefer a more traditional approach, this resource offers a printable version of the 1099 Div form for the year 2021. This allows you to fill out the form manually and submit it via mail or other designated channels. It can be particularly useful if you prefer to have physical copies of your tax documents.

If you prefer a more traditional approach, this resource offers a printable version of the 1099 Div form for the year 2021. This allows you to fill out the form manually and submit it via mail or other designated channels. It can be particularly useful if you prefer to have physical copies of your tax documents.

1099 Tax Calculator 2021 - 1099 Forms

Calculating your taxes can be a complex task, especially when dealing with various sources of income. This resource offers a helpful tax calculator specifically designed for 1099 forms. By inputting your income information, deductions, and other relevant details, the calculator determines your tax liability and provides you with accurate results.

Calculating your taxes can be a complex task, especially when dealing with various sources of income. This resource offers a helpful tax calculator specifically designed for 1099 forms. By inputting your income information, deductions, and other relevant details, the calculator determines your tax liability and provides you with accurate results.

TSP 2020 Form 1099-R Statements Should Be Examined Carefully

If you are a participant in the Thrift Savings Plan (TSP), it’s essential to review your Form 1099-R statements carefully. This resource highlights the importance of examining these statements to ensure their accuracy. By thoroughly reviewing the information, you can identify any discrepancies and take appropriate action to rectify them if necessary.

If you are a participant in the Thrift Savings Plan (TSP), it’s essential to review your Form 1099-R statements carefully. This resource highlights the importance of examining these statements to ensure their accuracy. By thoroughly reviewing the information, you can identify any discrepancies and take appropriate action to rectify them if necessary.

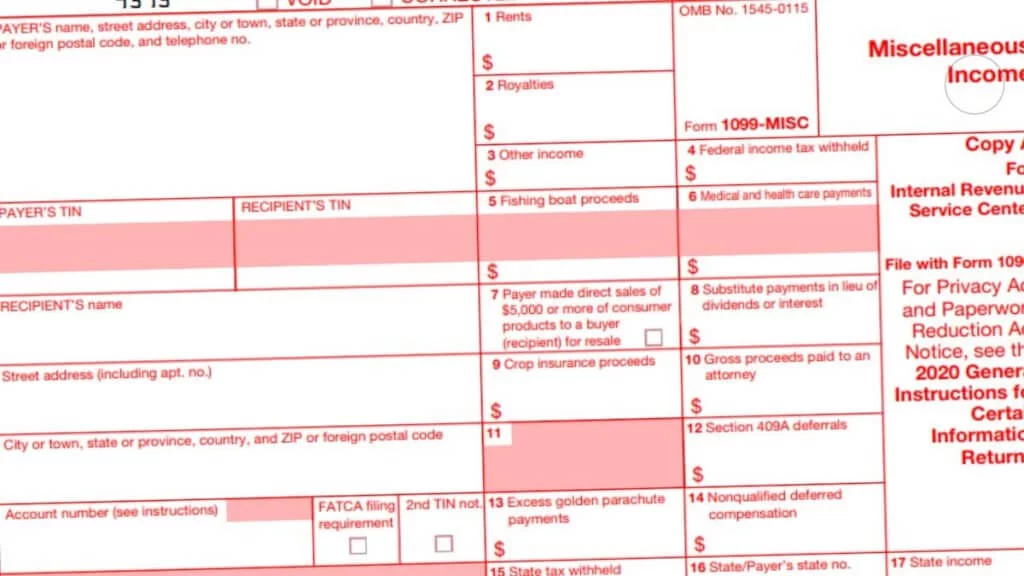

Printable 1099-misc 2022 - Printable World Holiday

To make the filing process more straightforward, you can access printable 1099-misc forms for the year 2022 through this resource. These forms are easy to download and print, allowing you to complete them at your convenience. It ensures that you have the necessary forms readily available when it’s time to file your taxes.

To make the filing process more straightforward, you can access printable 1099-misc forms for the year 2022 through this resource. These forms are easy to download and print, allowing you to complete them at your convenience. It ensures that you have the necessary forms readily available when it’s time to file your taxes.

[新しいコレクション] independent contractor printable 1099 form 2021 216171

![[新しいコレクション] independent contractor printable 1099 form 2021 216171](https://www.pdffiller.com/preview/520/624/520624624/large.png) If you operate as an independent contractor, this resource provides a printable version of the 1099 form tailored to your needs. You can easily download the form and fill it out with the relevant information. This ensures that you are compliant with tax regulations and accurately report your income as an independent contractor.

If you operate as an independent contractor, this resource provides a printable version of the 1099 form tailored to your needs. You can easily download the form and fill it out with the relevant information. This ensures that you are compliant with tax regulations and accurately report your income as an independent contractor.

[最も好き] 1099 c form 2020 166315-2020 form 1099-c cancellation of debt

If you have experienced the cancellation of debt, it’s essential to familiarize yourself with the 1099-C form. This resource provides a printable version of the form specifically for the year 2020. By completing this form accurately, you can comply with reporting requirements and avoid potential tax implications.

Form 1099 Definition

:max_bytes(150000):strip_icc()/1099r-eda9fdcb4d82449da27f9f30a318aaa3.jpg) To gain a better understanding of the 1099 form and its purpose, it’s important to know its definition and significance. This resource offers insights into the form’s definition, helping you grasp its role in reporting income from various sources outside of regular employment.

To gain a better understanding of the 1099 form and its purpose, it’s important to know its definition and significance. This resource offers insights into the form’s definition, helping you grasp its role in reporting income from various sources outside of regular employment.

Instructions for Forms 1099-MISC and 1099-NEC (2021) | Internal Revenue

This resource provides detailed instructions for filling out and submitting the Forms 1099-MISC and 1099-NEC for the year 2021. By carefully following these instructions, you can ensure that you meet all the necessary requirements and file your forms correctly.

This resource provides detailed instructions for filling out and submitting the Forms 1099-MISC and 1099-NEC for the year 2021. By carefully following these instructions, you can ensure that you meet all the necessary requirements and file your forms correctly.

1099 vs W2 Calculator (To Estimate Your Tax Difference)

If you are considering transitioning from a W2 employee to a 1099 independent contractor, it’s crucial to understand the potential tax differences. This resource offers a helpful calculator that allows you to estimate the tax implications of this transition. By comparing the two scenarios, you can make an informed decision and plan accordingly.

If you are considering transitioning from a W2 employee to a 1099 independent contractor, it’s crucial to understand the potential tax differences. This resource offers a helpful calculator that allows you to estimate the tax implications of this transition. By comparing the two scenarios, you can make an informed decision and plan accordingly.

By utilizing these resources, you can navigate the various aspects of the 1099 form more effectively. Whether you prefer to e-file, download printable versions, or seek clarification through instructions, these tools provide valuable support. Remember to consult with a tax professional or the Internal Revenue Service (IRS) for any specific questions or concerns that arise during the process. Stay organized, keep accurate records, and meet all deadlines to ensure a seamless tax filing experience.